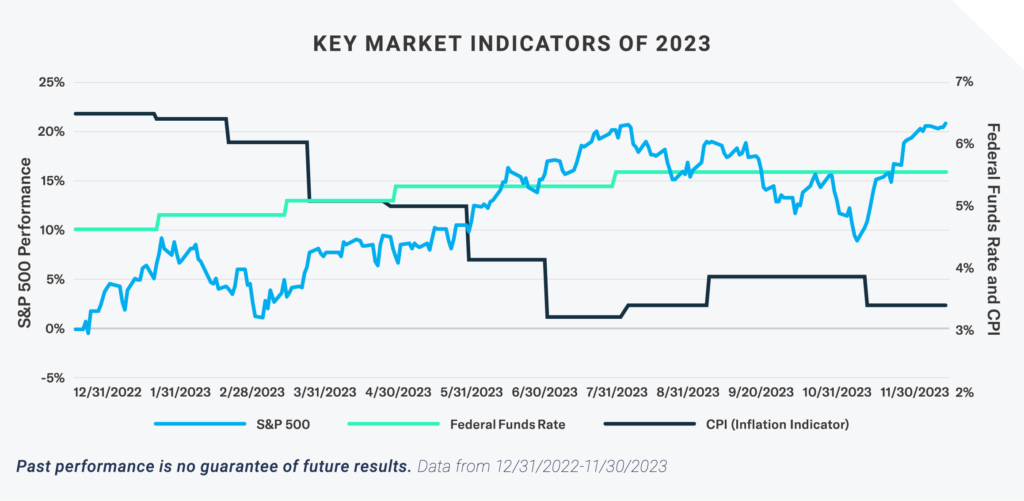

The turn of the calendar is always a time of mixed emotions as we look back on the year that has passed, both its challenges and rewards, and begin to focus on the year ahead. 2023 was a year of ups and downs but after a rough patch in the autumn, equity markets rebounded and several sectors are projected to end the year with double digit returns.

Whether this can continue is a question all investors are asking right now. Recent economic data generally is positive. For example, as of 11/29/2023, GDP growth was more than 5% and unemployment has remained low. High prices continue to bedevil individuals, but the rate of inflation has come down.

However, the economy faces a broad array of questions. What are the implications if the Federal Reserve holds off on raising interest rates higher, and possibly even cuts them? Will consumers continue to spend and support the economy? With multiple headlines recently highlighting layoffs, will unemployment rise, and the economy slow? Will overseas turmoil have an impact on the U.S. economy? What is the likelihood that the dollar will decline, especially if rates fall, and how does that affect international markets? The answers to those questions will play a large role in determining the course of the markets in 2024.

Still, as we look ahead to 2024, we would describe our mood as cautiously optimistic. Yes, it is likely that economic growth will remain positive, but the challenges we face could derail that optimism. Investors are likely to face bouts of volatility in 2024, and uncertainty throughout the year. Against that backdrop, here are four investment themes to consider for 2024:

Focus on income diversifiers.Given the high interest rate environment we find ourselves in, and the potential for heightened volatility, investors are looking to diversify their income streams. Even if the Federal Reserve begins cutting rates in 2024, yields are likely to remain at levels not seen in years. Investors are seeking to supplement their existing bond and dividend income streams in the following ways:

- Seek income while managing duration risk. Risk averse investors can now earn material monthly income while limiting interest rate risk in the form of low duration using vehicles that track the Secured Overnight Financing Rate.

- Consider high free cash flow yield stocks. Stocks with high free cash flow yields historically have offered more stability than the average U.S. stock, while trading at a discount to the overall market, as measured by the S&P 500 Index.

- Add tactical covered calls to blue chip equity income. Investors may be able to manage market volatility by utilizing a strategy long deployed by professional investors: an actively managed basket of high-quality dividend paying stocks while seeking additional income and hedging against market declines through tactical option writing on individual stocks.

Identify opportunities arising from the dollar. There are a variety of factors that affect changes in the U.S. dollar, and the potential for the Fed to cut rates in 2024 has made many investors aware that the U.S. dollar could selloff. In the event of a selloff of the U.S. dollar, investors may be faced with a range of prospects, but we believe that international equities and commodities generally look the most attractive. These asset classes have historically been under allocated to and we believe they may present opportunities in 2024.

Tap into digital transformation innovations. Investors may also want to consider complimenting their traditional stock portfolio by adding tactical positions focused on themes that offer long-term growth potential. We are living in a time of extraordinary technological and social change, with widespread economic effects.

For example, blockchain technology holds the possibility of revolutionizing currency and other markets. And digital commerce is becoming the norm, as traditional retail continues to evolve. However, traditional market cap or sector investing may miss out on the potential these technologies offer. Themes often play out over many years and should be thought of as long-term investments; however, they can often be market leaders and can potentially add alpha to core stock allocations.1

Recognize the implications of resource demand and scarcity. Often the emergence of new technologies can also create demand in “old economy” resources. Take for example, the growth of electric vehicles, which has fostered demand for the metals used in batteries and other technologies used for these vehicles. Similarly, silver is an important industrial metal for electronics, including electric vehicles, while also serving as a store of value. Meanwhile, although oil and gas prices fell in 2023, they are essential for the economy and may still be in limited supply, and a diversified basket of these stocks can offer an attractive dividend.

CONCLUSION

Between the Federal Reserve policy, geopolitical tensions, and a potentially contentious U.S. election year, no one can say for sure what 2024 will hold. Throughout the year, there undoubtedly will be bouts of volatility, and unexpected—and perhaps unpleasant—surprises. But even if it is impossible to accurately predict the future, it is less difficult to prepare for it. By being diversified and disciplined, while maintaining the flexibility to seek opportunities to strengthen portfolios, investors can have the opportunity to be well prepared for whatever 2024 brings.

RELATED ETFs

Income Focused

U.S. Dollar Sensitive

Digital Transformation Focused

Resource Focused

Index:

Indexes are unmanaged and it’s not possible to invest directly in an index. The S&P 500 Total Return Index is a market-capitalization weighted index of the 500 largest U.S. publicly traded companies.

The Federal Funds Rate is a target interest rate set by the central bank.

CPI, or Consumer Price Index, is the weighted average of prices for a basket of goods and services in U.S. consumer spending.

1Alpha is a historical measurement of the amount that an investment returned relative to the market index or other broad benchmark.