Fund Details

| Ticker | COWS |

| Inception | 9/13/2023 |

| Primary Exchange | Nasdaq |

| CUSIP | 032108698 |

| Net Assets | N/A |

| Shares Outstanding | N/A |

| # of Holdings (view all holdings) | N/A |

Fees & Expense

| Management Fee | 0.39% |

| Other Expenses | 0.00% |

| Total Annual Fund Operating Expenses | 0.39% |

| Expense Waiver/Reimbursement1 | (0.20%) |

| Net Expense Ratio | 0.19% |

Index Details

| Index Name | Kelly US Cash Flow Dividend Leaders Index |

| Index Provider | Kelly Indexes, LLC |

| Index Ticker | COWSETF |

| Weighting | Modified Equal Weight |

| Rebalance Frequency | Quarterly |

| Index Website | kellyintel.com |

| Index Methodology | |

1 The Fund's investment adviser has agreed to waive the management fees so the Fund’s net expense ratio will not exceed 0.19% of AUM, for assets up to $100 million until at least January 28, 2027.

Fund Documents

Insights

Three Reasons to Own COWS:

- High Free Cash Flow Meets Dividend Growth: Strategy is focused on high free cash flow (FCF) companies that pay and have historically grown dividends.

- Beyond the Rearview Mirror: Using a quantitative selection process that combines trailing and forward free cash flow metrics delivers a portfolio that balances past and forecasted cash flow potential.

- Diversification & Risk control: Strategy seeks an equal weight portfolio with an industry exposure cap of 24% to both diversify and limit company and industry-specific risks.

Payout ratio is forward-looking and calculated by dividing the forward 12-month indicated dividend by the forward 12-month consensus earnings per share forecast.

Objective and Strategy

COWS is a strategy driven ETF investing in companies with a blend of high trailing and future free cash flow yields that have a history of growing and paying dividends. The portfolio aims to provide long-term capital appreciation and monthly income distributions. COWS seeks investment results that correspond generally to the Kelly US Cash Flow Dividend Leaders Index.

FCF is the remaining cash a company has after covering all expenses.

High FCF is one way to indicate the financial stability of a company.

Trailing FCF measures a company’s remaining cash over a past period of time.

Future FCF estimates a company’s future cash flows and ability to be profitable.

Yield

| Distribution Rate* | N/A | 30-Day SEC Yield** | N/A | |

| Distribution Frequency | Monthly | Unsubsidized 30-Day SEC Yield*** | N/A | |

* Distribution Rate is the normalized current distribution (annualized) over NAV per share. Distribution stated includes estimated net investment income and no return of capital. See Form 19a-1.

** 30-Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows for fairer comparisons among bond funds. It is based on the most recent month end. This figure reflects the income earned from dividends – excluding option income – during the period after deducting the Fund’s expenses for the period.

*** Unsubsidized 30-Day SEC Yield is what a fund's 30-Day SEC Yield would have been had no fee waiver or expense reimbursement been in place over the period.

NAV and Market Price

| Previous Day's NAV | Previous Day's Market Price | |||

|---|---|---|---|---|

| Net Asset Value | N/A | Closing Price | N/A | |

| Daily Change | N/A | Daily Change | N/A | |

| % Daily Change | N/A | % Daily Change | N/A | |

| 30-Day Median Bid/Ask Spread | N/A | Premium/Discount % | N/A | |

| Premium Discount History | ||||

Daily Price/NAV Performance

Fund Holdings

| TOP 10 HOLDINGS | |||

|---|---|---|---|

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security.

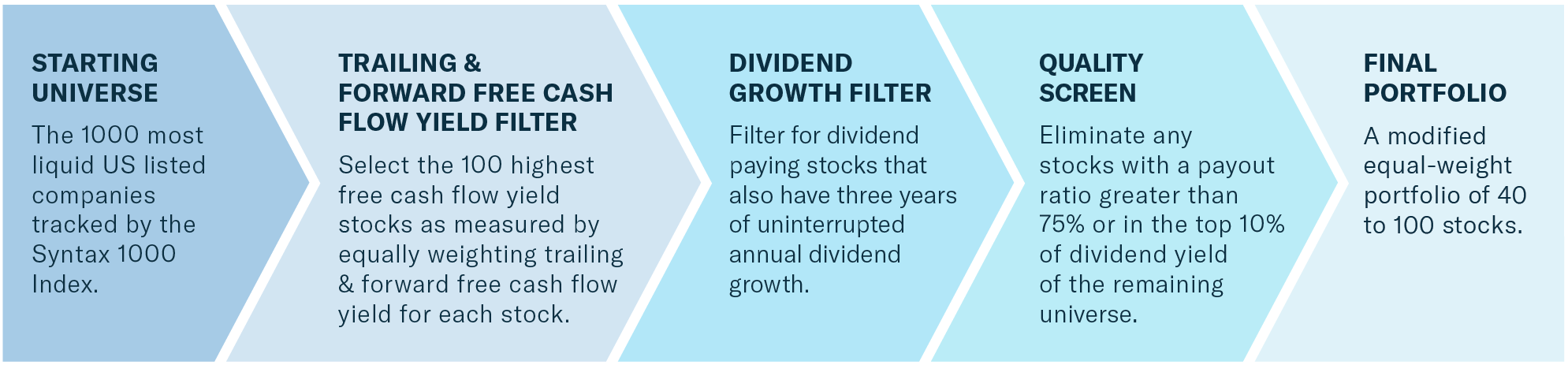

COWS Selection Methodology

Starting Universe

The 800 most liquid US listed companies tracked by the Syntax 1000 Index.

Trailing & Forward Free Cash Flow Yield Filter

Select the 200 highest free cash flow yield stocks as measured by equally weighting trailing & forward free cash flow yield for each stock.

Dividend Growth Filter

Filter for dividend paying stocks that also have three years of uninterrupted annual dividend growth.

Quality Screen

Eliminate any stocks with a payout ratio greater than 75% or in the top 10% of dividend yield of the remaining universe.

Final Portfolio

A modified equal-weight portfolio of 40 to 50 stocks.

The Syntax US 1000 Index is a broad-based US equity index that tracks the top 1000 companies within the Syntax US 3000 Index, excluding companies in the financials sector as determined by Syntax LLC.

High Free Cash Flow & Dividend Growth

Past performance is not a guarantee of future results. Index performance is not representative of fund performance. Source: Amplify ETFs and Syntax LLC. Yield on 06/30/2025. Trailing free cash flow yield is an indicator that compares free cash flow and market cap. Trailing 12 month dividend yield includes all dividends paid during the past year in order to calculate the dividend yield.

Sector Allocation

Market Capitalization

| LARGE CAP (> $10B): | N/A |

| MID CAP ($2B - $10B): | N/A |

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security.

Performance

| CUMULATIVE (%) | ANNUALIZED (%) | ||||||

|---|---|---|---|---|---|---|---|

| 1 Mo. | 3 Mo. | 6 Mo. | YTD | Since Inception (9/13/23) |

1 Yr. | Since Inception (9/13/23) |

|

| Month end as of TBD | |||||||

| Fund NAV | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Closing Price | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| COWSETF Index | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| S&P 500 TR Index | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Quarter end as of TBD | |||||||

| Fund NAV | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Closing Price | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| COWSETF Index | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| S&P 500 TR Index | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Brokerage commissions will reduce returns. A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The closing price or market price is the most recent price at which the fund was traded.

Indexes are unmanaged and it’s not possible to invest directly in an index. The COWSETF Index is comprised of at least 40 and up to 100 mid- to large-capitalization publicly traded equity securities of US companies exhibiting characteristics of high free cash flow and consistent dividend growth. The S&P 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

Premium/Discount

The table and line graph are provided to show the frequency at which the closing price of the Fund was at a premium (above) or discount (below) to the Fund's daily net asset value ("NAV"). The table and line graph represent past performance and cannot be used to predict future results. Shareholders may pay more than NAV when buying Fund shares and receive less than an NAV when those shares are sold because shares are bought and sold at current market prices.

| Q1 | Q2 | Q3 | Q4 | ||

|---|---|---|---|---|---|

| Days traded at premium | N/A | N/A | N/A | N/A | N/A |

| Days traded at net asset value | N/A | N/A | N/A | N/A | N/A |

| Days traded at discount | N/A | N/A | N/A | N/A | N/A |

COWS Distributions

| EX-DATE | RECORD DATE | PAYABLE DATE | AMOUNT |

|---|---|---|---|

|

2023 |

|||

| 10/27/23 | 10/30/23 | 10/31/23 | $0.03812 |

| 11/28/23 | 11/29/23 | 11/30/23 | $0.09942 |

| 12/26/23 | 12/27/23 | 12/29/23 | $0.04471 |

|

2024 |

|||

| 1/29/24 | 1/30/24 | 1/31/24 | $0.03493 |

| 2/27/24 | 2/28/24 | 2/29/24 | $0.05649 |

| 3/26/24 | 3/27/24 | 3/28/24 | $0.04868 |

| 4/26/24 | 4/29/24 | 4/30/24 | $0.02642 |

| 5/30/24 | 5/30/24 | 5/31/24 | $0.07424 |

| 6/27/24 | 6/27/24 | 6/28/24 | $0.05711 |

| 7/30/24 | 7/30/24 | 7/31/24 | $0.03647 |

| 8/29/24 | 8/29/24 | 8/30/24 | $0.06554 |

| 9/27/24 | 9/27/24 | 9/30/24 | $0.04954 |

| 10/30/24 | 10/30/24 | 10/31/24 | $0.03916 |

| 11/27/24 | 11/27/24 | 11/29/24 | $0.04977 |

| 12/27/24 | 12/27/24 | 12/31/24 | $0.07253 |

|

2025 |

|||

| 1/30/25 | 1/30/25 | 1/31/25 | $0.06784 |

| 2/27/25 | 2/27/25 | 2/29/25 | $0.07050 |

| 3/28/25 | 3/28/25 | 3/31/25 | $0.05777 |

| 4/29/25 | 4/29/25 | 4/30/25 | $0.03173 |

| 5/29/25 | 5/29/25 | 5/30/25 | $0.06174 |

| 6/27/25 | 6/27/25 | 6/30/25 | $0.07409 |

| 7/30/25 | 7/30/25 | 7/31/25 | $0.03974 |

| 8/28/25 | 8/28/25 | 8/29/25 | $0.04133 |

| 9/29/25 | 9/29/25 | 9/30/25 | $0.09059 |

| 10/30/25 | 10/30/25 | 10/31/25 | $0.03197 |

| 11/26/25 | 11/26/25 | 11/28/25 | $0.05875 |

| 12/29/25 | 12/29/25 | 12/30/25 | $0.05173 |

|

2026 |

|||

| 1/29/26 | 1/29/26 | 1/30/26 | $0.03987 |

| 2/26/26 | 2/26/26 | 2/27/26 | $0.03112 |

| 3/30/26 | 3/30/26 | 3/31/26 | |

| 4/29/26 | 4/29/26 | 4/30/26 | |

| 5/28/26 | 5/28/26 | 5/29/26 | |

| 6/29/26 | 6/29/26 | 6/30/26 | |

| 7/30/26 | 7/30/26 | 7/31/26 | |

| 8/28/26 | 8/28/26 | 8/31/26 | |

| 9/29/26 | 9/29/26 | 9/30/26 | |

| 10/29/26 | 10/29/26 | 10/30/26 | |

| 11/27/26 | 11/27/26 | 11/30/26 | |

| 12/29/26 | 12/29/26 | 12/30/26 | |

There is no guarantee that distributions will be made.

Investing involves risk, including the possible loss of principal. The fund is new with limited operating history. You could lose money by investing in the Fund. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. There can be no assurance that the Fund’s investment objectives will be achieved. Brokerage commissions will reduce returns. Although the Shares are listed for trading on the Exchange, there can be no assurance that an active trading market for the Shares will develop or be maintained.

The value of the Shares will fluctuate with changes in the value of the equity securities in which it invests. Because the Fund is non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund, changes in the market value of a single investment could cause greater fluctuations in Share price than would occur in a diversified fund. Diversification does not assure a profit or protect against a loss in a declining market. The Fund is susceptible to operational risks through breaches in cyber security. Small and/or mid-capitalization companies may be more vulnerable to adverse general market or economic developments.

There is no guarantee that a company will pay or continually increase its dividends. The Fund intends to estimate annual income and pay in monthly installments. In doing so, some portion of the distribution could be considered a return of capital for tax purposes.

The Fund employs a “passive management” or indexing investment approach that seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index. Differences in timing of trades and valuation as well as fees and expenses, may cause the fund to not exactly replicate the index known as tracking error.

Amplify Investments LLC serves as the investment adviser to the Fund. Kelly Strategic Management, LLC and Penserra Capital Management LLC each serve as investment sub-advisers to the Fund.

Amplify ETFs are distributed by Foreside Fund Services, LLC.