Fund Details

| Ticker | IDVO |

| Inception | 9/8/2022 |

| Primary Exchange | NYSE Arca |

| CUSIP | 032108722 |

| Net Assets | N/A |

| Shares Outstanding | N/A |

| # of Holdings (view all holdings) | N/A |

| Expense Ratio: | N/A |

Fund Characteristics

| Weighted Avg. Market Cap | N/A |

| Price-to-earnings | N/A |

| Price-to-book | N/A |

| Standard deviation | N/A |

Standard deviation measures how dispersed returns are around the average. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile.

Index Details

| Index Name | EQM Lithium & Battery Technology Index |

| Index Ticker | BATTIDX |

| Index Provider | EQM Indexes |

| Weighting Methodology | Modified market-cap |

| Rebalance Frequency | Quarterly |

| Index Website | eqmindexes.com |

Three Reasons to Own IDVO:

- Two Potential Income Streams: IDVO seeks to provide income from international dividend-paying stocks and by opportunistically writing covered calls on those stocks.

- Seeks to Lower Volatility: Dividend and option income reduce share price volatility versus the overall market during times of broad-based market declines.

- Professionally Managed: Access a professionally managed dividend and option income international investment strategy through the efficiency of an ETF.

Why International?

Historically, foreign companies can provide diversification if added to US-only portfolios. In many cases, these companies offer the potential for faster growth than typical domestic companies. Additionally, writing covered calls on these foreign stocks have historically provided higher premiums.

Objective and Strategy

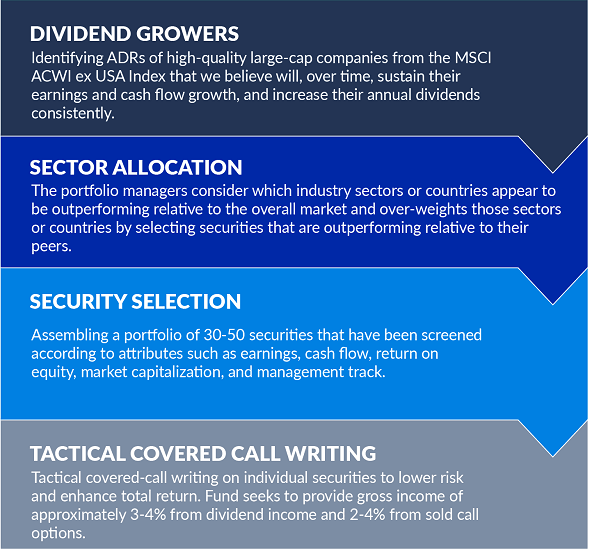

IDVO is an ETF of high-quality international large and mid-cap companies through American Depositary Receipts (ADRs) with a history of dividend and earnings growth, along with a tactical covered call strategy on individual securities. Capital Wealth Planning LLC (CWP) and Seymour Asset Management LLC serve as investment sub-advisers to the Fund.

Yield

| Distribution Frequency | Monthly | 30-Day SEC Yield** | N/A | |

| Distribution Rate* | N/A | |||

* Distribution Rate is the normalized current distribution (annualized) over NAV per share. In addition to net interest income, distribution on 6/30/2025 included an estimated return of capital of 78%. See Form 19a-1.

** 30-Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows for fairer comparisons among bond funds. It is based on the most recent month end. This figure reflects the income earned from dividends – excluding option income – during the period after deducting the Fund’s expenses for the period.

IDVO Distributions

| EX-DATE | RECORD DATE | PAYABLE DATE | AMOUNT |

|---|---|---|---|

|

2022 |

|||

| 9/28/22 | 9/29/22 | 9/30/22 | $0.12365 |

| 10/27/22 | 10/28/22 | 10/31/22 | $0.12135 |

| 11/28/22 | 11/29/22 | 11/30/22 | $0.13215 |

| 12/28/22 | 12/29/22 | 12/30/22 | $0.13165 |

|

2023 |

|||

| 1/27/23 | 1/30/23 | 1/31/23 | $0.14035 |

| 2/24/23 | 2/27/23 | 2/28/23 | $0.13440 |

| 3/29/23 | 3/30/23 | 3/31/23 | $0.13230 |

| 4/26/23 | 4/27/23 | 4/28/23 | $0.13544 |

| 5/26/23 | 5/30/23 | 5/31/23 | $0.13220 |

| 6/28/23 | 6/29/23 | 6/30/23 | $0.13820 |

| 7/27/23 | 7/28/23 | 7/31/23 | $0.14325 |

| 8/29/23 | 8/30/23 | 8/31/23 | $0.13720 |

| 9/27/23 | 9/28/23 | 9/29/23 | $0.13550 |

| 10/27/23 | 10/30/23 | 10/31/23 | $0.13235 |

| 11/28/23 | 11/29/23 | 11/30/23 | $0.14130 |

| 12/27/23 | 12/28/23 | 12/29/23 | $0.14370 |

|

2024 |

|||

| 1/29/24 | 1/30/24 | 1/31/24 | $0.14400 |

| 2/27/24 | 2/28/24 | 2/29/24 | $0.14725 |

| 3/26/24 | 3/27/24 | 3/28/24 | $0.15270 |

| 4/26/24 | 4/29/24 | 4/30/24 | $0.15150 |

| 5/30/24 | 5/30/24 | 5/31/24 | $0.15795 |

| 6/27/24 | 6/27/24 | 6/28/24 | $0.15320 |

| 7/30/24 | 7/30/24 | 7/31/24 | $0.15360 |

| 8/29/24 | 8/29/24 | 8/30/24 | $0.15440 |

| 9/27/24 | 9/27/24 | 9/30/24 | $0.15520 |

| 10/30/24 | 10/30/24 | 10/31/24 | $0.15609 |

| 11/27/24 | 11/27/24 | 11/29/24 | $0.15425 |

| 12/30/24 | 12/30/24 | 12/31/24 | $0.15155 |

|

2025 |

|||

| 1/30/25 | 1/30/25 | 1/31/25 | $0.15595 |

| 2/27/25 | 2/27/25 | 2/28/25 | $0.16105 |

| 3/28/25 | 3/28/25 | 3/31/25 | $0.16155 |

| 4/29/25 | 4/29/25 | 4/30/25 | $0.15915 |

| 5/29/25 | 5/29/25 | 5/30/25 | $0.16875 |

| 6/27/25 | 6/27/25 | 6/30/25 | $0.16905 |

| 7/30/25 | 7/30/25 | 7/31/25 | |

| 8/28/25 | 8/28/25 | 8/29/25 | |

| 9/29/25 | 9/29/25 | 9/30/25 | |

| 10/30/25 | 10/30/25 | 10/31/25 | |

| 11/26/25 | 11/26/25 | 11/28/25 | |

| 12/30/25 | 12/30/25 | 12/31/25 | |

There is no guarantee that distributions will be made.

Fund Holdings

| TOP 10 HOLDINGS | |||

|---|---|---|---|

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security.

IDVO Selection Methodology

Country Allocation

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

| N/A | N/A |

Country Allocation

Sector Allocation

Market Capitalization

| LARGE CAP (> $10B): | N/A |

| MID CAP ($2B - $10B): | N/A |

| SMALL CAP ($300M - < $2B): | N/A |

| MICRO CAP (<$300M): |

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security.

Performance

| CUMULATIVE (%) | ANNUALIZED (%) | ||||||

|---|---|---|---|---|---|---|---|

| 1 Mo. | 3 Mo. | 6 Mo. | YTD | Since Inception (9/8/22) |

1 Yr. | Since Inception (9/8/22) |

|

| Month end as of TBD | |||||||

| Fund NAV | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Closing Price | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| MSCI ACWI ex USA Index | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Quarter end as of TBD | |||||||

| Fund NAV | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Closing Price | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| MSCI ACWI ex USA Index | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Brokerage commissions will reduce returns. A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The closing price or market price is the most recent price at which the fund was traded.

The MSCI ACWI ex USA Index is an unmanaged, free float-adjusted market capitalization-weighted index designed to measure the combined equity performance of developed and emerging market countries, excluding the United States. It is not possible to invest directly in an index.

NAV and Market Price

| Previous Day's NAV | Previous Day's Market Price | |||

|---|---|---|---|---|

| Net Asset Value | N/A | Closing Price | N/A | |

| Daily Change | N/A | Daily Change | N/A | |

| % Daily Change | N/A | % Daily Change | N/A | |

| 30-Day Median Bid/Ask Spread | N/A | Premium/Discount % | N/A | |

| Premium Discount History | ||||

Daily Price/NAV Performance

Premium/Discount

The table and line graph are provided to show the frequency at which the closing price of the Fund was at a premium (above) or discount (below) to the Fund's daily net asset value ("NAV"). The table and line graph represent past performance and cannot be used to predict future results. Shareholders may pay more than NAV when buying Fund shares and receive less than an NAV when those shares are sold because shares are bought and sold at current market prices.

| Calendar Year | Calendar Year through | |

|---|---|---|

| Days traded at premium | N/A | N/A |

| Days traded at net asset value | N/A | N/A |

| Days traded at discount | N/A | N/A |

*A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security.