Breakwave Tanker Shipping ETF

Fund Details

| Ticker | BWET™ |

| Inception | 05/03/2023 |

| Primary Exchange | NYSE Arca |

| CUSIP | 03210A206 |

| Net Assets | N/A |

| Shares Outstanding | N/A |

| # of Holdings (view all holdings) | N/A |

| Expense Ratio: | 3.50%2 |

Index Details

| Index Name | Breakwave Tanker Futures Index |

| Index Ticker | BWETFF |

| Index Provider | Breakwave Advisors LLC |

| Weighting Methodology | Proprietary |

| Rebalance Frequency | Annual |

| Index Website | breakwaveadvisors.com |

Why Invest in BWET?

- The first and only freight futures exchange-traded product exclusively focused on crude oil tanker freight rates.1

- Strives to profit from increases in oil freight futures beyond what is already priced in the market.

- A pure play exposure to crude oil tanker shipping, an instrumental part of the global energy commodity market, uncorrelated to other major assets.

Objective and Strategy

The Breakwave Tanker Shipping ETF (BWET) is an exchange-traded fund (ETF) designed to reflect the daily price movements of indices that track the future cost of transporting crude oil. BWET offers investors unlevered exposure to oil tanker futures without the need for a futures account.

Portfolio Allocation

- Freight Futures of one-to-six months forward

- Weighted average expiration of 60-90 days

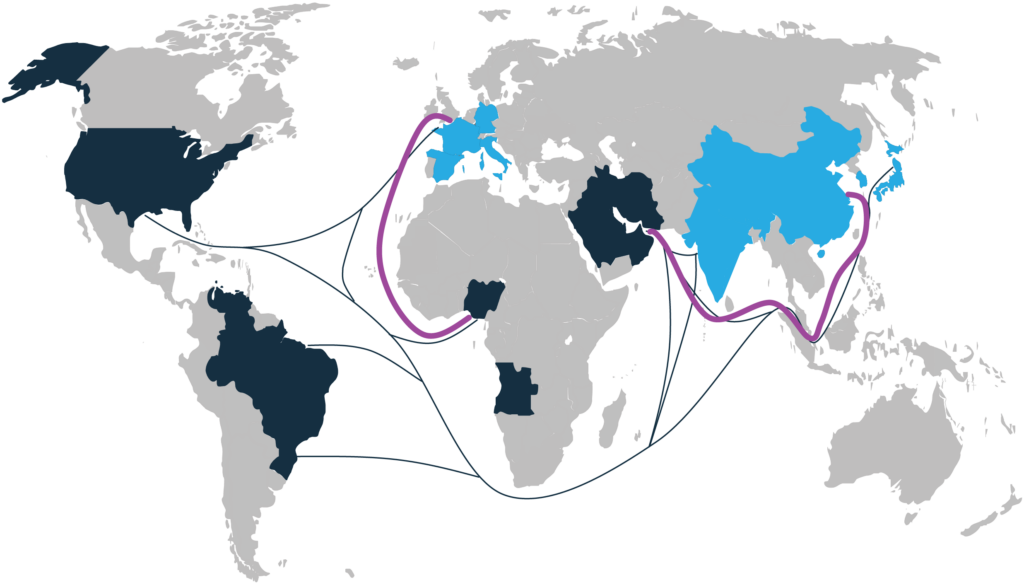

- 90% TD3C (VLCCs)

- 10% TD20 (Suezmax)

90% VLCC

Very large crude carrier

Largest cargo ship

Mainly used for transporting crude oil from the Middle East and Americas to Asia

10% SUEZMAX

Half-size of VLCCs

Mainly used in the Atlantic

Largest tanker that can use the Suez Canal

Major Crude Oil Trade Routes

- Major Crude Exporting Nations

- Major Crude Importing Nations

- Major Crude Tanker Routes

- BWET Focused Routes

NAV and Market Price

| Previous Day's NAV | Previous Day's Market Price | |||

|---|---|---|---|---|

| Net Asset Value | N/A | Closing Price | N/A | |

| Daily Change | N/A | Daily Change | N/A | |

| % Daily Change | N/A | % Daily Change | N/A | |

| 30-Day Median Bid/Ask Spread | N/A | Premium/Discount % | N/A | |

| Premium Discount History | ||||

Daily Price/NAV Performance

Fund Holdings

| TOP 10 HOLDINGS | |||

|---|---|---|---|

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security.

Thematic Allocation

Country Allocation

Market Capitalization

| LARGE CAP (> $10B): | N/A |

| MID CAP ($2B - $10B): | N/A |

| SMALL CAP ($300M - < $2B): | N/A |

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security.

Performance

| CUMULATIVE (%) | ANNUALIZED (%) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 Mo. | 3 Mo. | 6 Mo. | YTD | Since Inception (05/03/23) |

1 Yr. | 3 Yr. | 5 Yr. | Since Inception (05/03/23) |

|

| Month end as of TBD | |||||||||

| Fund NAV | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Closing Price | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Quarter end as of TBD | |||||||||

| Fund NAV | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Closing Price | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Brokerage commissions will reduce returns. A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The closing price or market price is the most recent price at which the fund was traded.

Premium/Discount

The table and line graph are provided to show the frequency at which the closing price of the Fund was at a premium (above) or discount (below) to the Fund's daily net asset value ("NAV"). The table and line graph represent past performance and cannot be used to predict future results. Shareholders may pay more than NAV when buying Fund shares and receive less than an NAV when those shares are sold because shares are bought and sold at current market prices.

| Calendar Year | Calendar Year through | |

|---|---|---|

| Days traded at premium | N/A | N/A |

| Days traded at net asset value | N/A | N/A |

| Days traded at discount | N/A | N/A |

BWET Distributions

| EX-DATE | RECORD DATE | PAYABLE DATE | AMOUNT |

|---|---|---|---|

|

2016 |

|||

| 06/20/16 | 06/22/16 | 06/23/16 | $0.0700 |

| 09/13/16 | 09/15/16 | 09/16/16 | $0.1200 |

| 12/28/16 | 12/30/16 | 1/3/17 | $0.1343 |

|

2017 |

|||

| 12/26/17 | 12/27/17 | 12/28/17 | $0.0035 |

|

2018 |

|||

| 12/24/18 | 12/26/18 | 12/27/18 | $0.0298 |

|

2019 |

|||

| 06/28/19 | 07/01/19 | 07/02/19 | $0.0200 |

| 12/30/19 | 12/31/19 | 1/02/20 | $0.0400 |

|

2020 |

|||

| 03/17/20 | 03/18/20 | 03/19/20 | $0.5800 |

| 06/15/20 | 06/16/20 | 06/17/20 | $0.0200 |

| 12/14/20 | 12/15/20 | 12/16/20 | $0.0400 |

|

2021 |

|||

| 06/22/21 | 06/23/21 | 06/24/21 | $0.0200 |

| 09/21/21 | 09/22/21 | 09/23/21 | $0.1200 |

| 12/28/21 | 12/29/21 | 12/30/21 | $0.0173 |

|

2022 |

|||

| 03/23/22 | 03/24/22 | 03/25/22 | $0.0249 |

| 06/22/22 | 06/23/22 | 06/24/22 | $0.0200 |

| 12/28/22 | 12/29/22 | 12/30/22 | $0.0590 |

|

2023 |

|||

| 06/21/23 | 06/22/23 | 06/23/23 | $0.0300 |

| 09/20/23 | 09/21/23 | 09/22/23 | $0.0100 |

| 12/27/23 | 12/238/23 | 12/29/23 | $0.0836 |

|

2024 |

|||

| 03/26/24 | 03/27/24 | 03/28/24 | |

| 06/27/24 | 06/27/24 | 06/28/24 | |

| 09/27/24 | 09/27/24 | 09/30/24 | |

| 12/30/24 | 12/30/24 | 12/31/24 | |

There is no guarantee that distributions will be made.

1First-to-market claim is based on a review of industry data as of May 3, 2023. No information to the contrary has come to our attention to date, for more information or inquiries about this claim, please contact info@amplifyetfs.com

The Fund is not a mutual fund or any other type of investment company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

An investment in the Fund involves significant risks. You could lose all or part of your investment in the Fund, and the Fund’s performance could trail that of other investments. The value of the Shares of the Fund relates directly to the value of, and realized profit or loss from, the Freight Futures and other assets held by the Fund, and fluctuations in price could materially affect the Fund’s shares. Investments in freight futures typically fluctuate in value with changes in spot charter rates. Charter rates for dry bulk vessels are volatile and have declined significantly since their historic highs and may remain at low levels or decrease further in the future. The Fund will not take defensive positions to protect against declining freight rates, which could cause a decline to the value of the Fund’s shares.

Although the Fund’s shares are listed and traded on the NYSE Arca, there can be no guarantee that an active trading market for the shares will be maintained. If an investor needs to sell shares at a time when no active trading market for them exists, the price the investor receives upon sale of the shares, assuming they were able to be sold, likely would be lower than if an active market existed.

Breakwave Advisors LLC (“Breakwave”) is a registered “commodity trading advisor” with the NFA and will act as such for the Fund. Breakwave specializes in shipping and freight investments.

On December 28, 2023, ETF Managers Capital LLC, as the sponsor of ETF Managers Group Commodity Trust I, entered into an agreement to resign as sponsor to the trust and transfer its role as the sponsor to Amplify Investments LLC, effective soon after necessary regulatory approval of the transfer. Amplify will serve as the new sponsor of the Trust, which consist of two series: Breakwave Dry Bulk Shipping ETF (BDRY) and the Breakwave Tanker Shipping ETF (BWET).

ETF Managers Capital LLC serves as the “commodity pool operator” to the Fund and is registered in such capacity with the NFA.

ETF Managers Capital LLC is a wholly owned subsidiary of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Breakwave Advisors LLC.

1First-to-market claim is based on a review of industry data as of May 3, 2023. No information to the contrary has come to our attention to date, for more information or inquiries about this claim, please contact info@amplifyetfs.com

2Breakwave has agreed to waive its fee and the Sponsor has agreed to assume the Fund’s Other Expenses (which term excludes brokerage fees, interest expenses, and extraordinary expenses) so that the Fund’s total annual expenses do not exceed 3.50% per annum through December 31, 2025 after which the expense limitation may be terminated and Fund shareholders may incur expenses higher than 3.50% annually, perhaps significantly higher.

The Fund is not a mutual fund or any other type of investment company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

An investment in the Fund involves significant risks. You could lose all or part of your investment in the Fund, and the Fund’s performance could trail that of other investments.

The Fund invests solely in Freight Futures. Such concentration may result in a high degree of volatility in the net asset value of the Fund under specific market conditions and over time. Futures are speculative, and the value of the Shares of the Fund relates directly to the value of, and realized profit or loss from, the Freight Futures and other assets held by the Fund, and fluctuations in price could materially affect the Fund’s shares.

Although the Fund’s shares are listed and traded on the NYSE Arca, there can be no guarantee that an active trading market for the shares will be maintained. If an investor needs to sell shares at a time when no active trading market for them exists, the price the investor receives upon sale of the shares, assuming they were able to be sold, likely would be lower than if an active market existed.

Breakwave Advisors LLC (“Breakwave”) is a registered “commodity trading advisor” with the NFA and will act as such for the Fund. Breakwave specializes in shipping and freight investments.

Amplify Investments LLC, the Sponsor, serves as the “commodity pool operator” to the Fund and is registered in such capacity with the NFA.

Amplify ETFs are distributed by Foreside Fund Services, LLC.