Ordering dinner, household supplies, or just about anything has never been easier – just click and it appears on your computer or arrives on your doorstep. Some e-commerce names are well established, but for others, growth trajectories are just beginning. E-commerce is still in its adolescence (Amazon 1 sold its first book in 1995), and experts agree decades of solid growth lie ahead. The pandemic accelerated what we already knew – for billions worldwide, shopping online is a must.

More Growth Ahead

Selling events have become more fluid. If it seems like there’s always something to shop for, well, there is.

1 As of December 7, 2021, Amazon has a 2.05% weighting in IBUY ETF 2 NRF Valentine’s Spending Survey 3 Alibaba, JD set new records to rack up record $115 billion of sales on Singles Day as regulations loom, cnbc.com, Nov. 12, 2020 4 Black Friday sees record online as US shoppers stay home, apnews.com, November 28, 2020 5 Americans spent a record online over 2020 holidays, and more e-commerce gains are expected, cnbc.com, January 12,2021

Trends Supporting E-Commerce

Many business and demographic trends support the continued growth of e-commerce:

Source for slide 2, 3, 5: 10 e-commerce trends that you need to know in 2021, oberlo.com, April 3, 2021

Source for slide 4: Forecast number of mobile devices worldwide from 2020 to 2025 (in billions), statistica.com, September 24, 2021

How Can Investors Capitalize on the Growth of E-Commerce Companies?

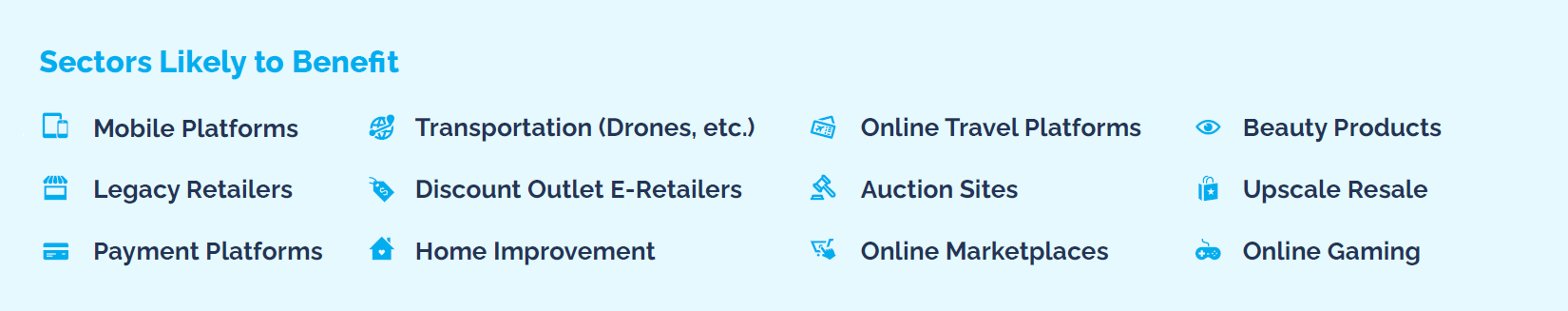

The ongoing pandemic has created hundreds of millions of new online shoppers. For an idea of just how fast e-commerce is growing, the consulting firm McKinsey estimated that at the height of pandemic, ten years of e-commerce growth happened in just 90 days.8 But even now, online retail in the U.S. only comprises about 14% of total retail sales. Industry analyst predict this will rise to 25% by 2025.9 One option for investors interested in digital commerce is the Amplify Online Retail ETF (IBUY), an actively managed ETF representing a pure play in the rapidly growing e-commerce sector.

Carefully consider the Funds’ investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Funds’ prospectuses, which may be obtained by calling 855-267-3837. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. A portfolio concentrated in a single industry, such as the online retail industry, makes it vulnerable to factors affecting the industry. The Fund may face more risks than if it were diversified broadly over numerous industries or sectors. Investments in consumer discretionary companies are tied closely to the performance of the overall domestic and international economy, interest rates, competition and consumer confidence. Online retail companies are subject to risks of consumer demand and sensitivity to profit margins. Additionally technology and internet companies are subject to rapidly changing technologies; short product life cycles; fierce competition; aggressive pricing and reduced profit margins; the loss of patent, copyright and trademark protections; cyclical market patterns; evolving industry standards; and frequent new product introductions. Information technology companies may be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Stocks of many internet companies have exceptionally high price-to-earnings ratios with little or no earnings histories. Information technology company stocks, especially those which are internet related, have experienced extreme price and volume fluctuations that are often unrelated to their operating performance. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Investments in smaller companies tend to have limited liquidity and greater price volatility than large-capitalization companies.

Investments in foreign securities involve greater volatility and political, economic, and currency risks and differences in accounting methods. The Fund’s return may not match or achieve a high degree of correlation with the return of the underlying Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Index.

Amplify Investments LLC is the Investment Adviser to the Funds, and Toroso Investments, LLC serves as the Investment Sub-Adviser.

Amplify ETFs are distributed by Foreside Fund

NDIV December 2023 Recap

Amplify Natural Resources Dividend Income ETF (NDIV) December 2023 recap includes portfolio attribution, yields, performance, allocations, and more.

DIVO December 2023 Recap

Amplify CWP Enhanced Dividend Income ETF (DIVO) December 2023 recap includes portfolio attribution, yields, performance, allocations, and more.

Amplify ETFs Declares December Income Distributions

December 2023 income distributions declared for income, thematic, and core ETFs.

2024 Investment Outlook: Four Investment Themes

The turn of the calendar is always a time of mixed emotions as we look back on the year that has passed, both its challenges and rewards, and begin to focus on the year ahead.

How Corporate Profits and Dividends Affect Investors

With the future of the economy still uncertain, what signs are there that companies might begin to see improved profitability?

BLOK-Chain Monthly December 2023

Staying Up-to-date with the Rapidly Evolving Blockchain Technology. BLOK-Chain Monthly Commentary for December 2023.