Perhaps nothing summarizes the investor experience better than the old quote that “nothing worth doing is easy.” The current market environment, as uncomfortable as it may be, serves as a reminder that staying invested is difficult. The very definition of investing involves sacrificing what we could buy and consume today in order to achieve more tomorrow. Over long periods, when combined with long-term trends and attractive investment themes, this is how investors can transform hard-earned savings into true wealth and financial freedom. What can all investors do to focus on the long run when the daily headlines and market swings can be alarming?

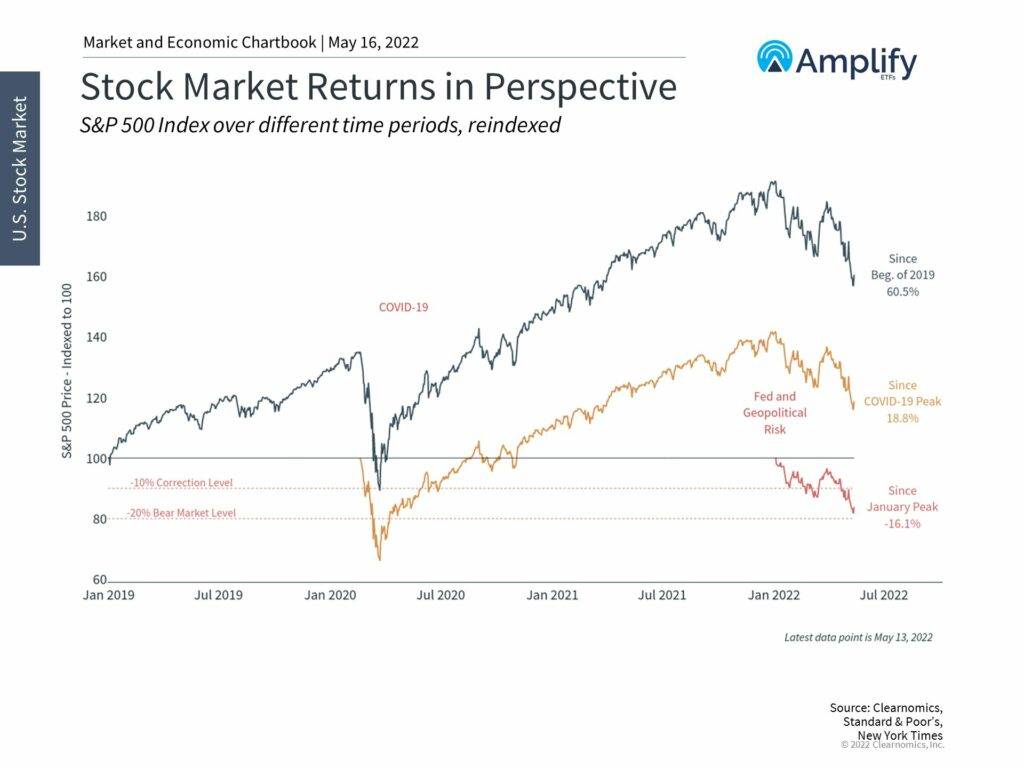

First, while the stock market is in the red for the year, zooming out paints a very different picture. The S&P 500 has gained 60.5% over the past three years, 18.8% since the pre-pandemic peak in early 2020, and 80% from the pandemic bottom. While investors may prefer a smooth ride, with steady gains day after day, this is unfortunately not how the market operates. Instead, the price of long-term gains is the ability to stomach short-term declines.

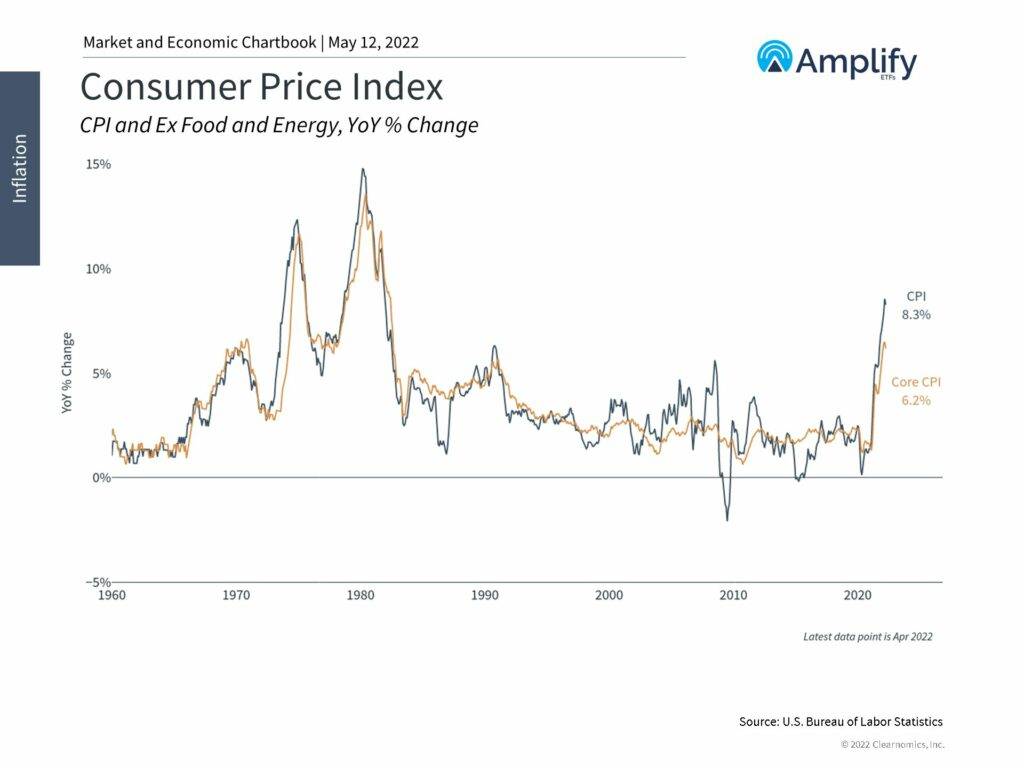

Second, inflation continues to heat up with the consumer price index rising 8.3% in April compared to the prior year. Price increases were much worse in certain categories such as energy (30.3% increase year-over-year), food (8.3%) and used cars (22.7%). And, while many economists expect prices to remain high due to the war in Ukraine, supply chain disruptions, and strong consumer demand, these numbers will likely also begin to roll over later in the year.

Recently, in response to the highest inflation rates in 40 years, the Federal Reserve raised interest rates by half a percent (50 basis points) at their May meeting. After a short recovery, major stock market indices began to struggle once again. At the moment, all major U.S. indices are down more than 10% for the year and the Nasdaq has fallen deeper into bear market territory. This is no doubt a challenging time for many investors, both emotionally and financially, especially for those who are either accustomed to or have only experienced the rising markets of the past decade or more.

One of the core principles of investing is that there is no reward without risk. Simply put, having the fortitude to stick it out when times are tough is exactly why long-term investors have historically been rewarded. In general, this is why stocks have achieved greater historical returns than “safer” assets: these returns are compensation for withstanding greater uncertainty. Of course, there may be times when investing seems easy and all prices rise, irrespective of risk, such as over the past two years or during the dot-com boom. When these periods inevitably end, it becomes clear which investors were truly following real underlying trends rather than just chasing stock prices. In times like these, it’s important for investors to focus on the factors and challenges driving this market.

Third, markets widely expected the Fed to begin raising policy rates and to end its asset purchase program in response to these inflation trends and strong economic growth. Not only did the Fed do exactly that, but they will likely accelerate their pace of tightening in the coming months. Current market expectations suggest that the fed funds rate could exceed 2.75% by the end of the year. This would mean more 50 basis point rate hikes at upcoming meetings.

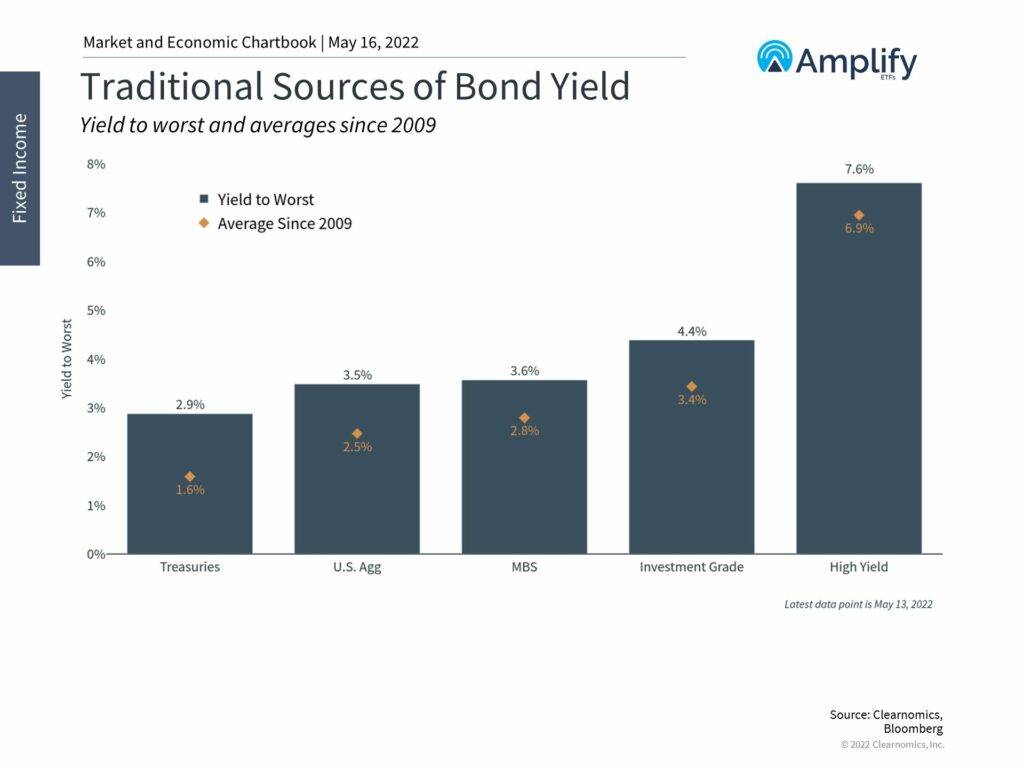

Finally, perhaps the most persistent impact of the Fed’s change in policy is its effect on interest rates. The 10-year Treasury yield has exceeded 3% for the first time since 2018. The yield curve has flattened and even “inverted” over the past two months. Many economists use as a predictor of recession, although there is often a long lead time before the economy truly decelerates.

This matters because interest rates both affect the economy and reflect underlying economic trends. The flattening of the curve is natural in a maturing business cycle as short-term rates catch up to long-term ones. This can slow growth and prevent an overheating economy by raising the cost of borrowing for businesses, borrowers, homebuyers, etc. However, rates at this level are still quite low by historical standards, especially with inflation at its highest level since the early 1980s. The silver lining, if there is one, is that investors can benefit from higher levels of portfolio income.

Thus, we are not out of the woods yet and this discussion is not meant to ignore or downplay the challenges that lie ahead for markets. However, many of these challenges are already widely understood by investors who have been grappling with them for months, if not years. The point is that investing activity can occur over many timeframes. Ultimately, investors have been rewarded in the long run exactly because they can stick it out in difficult times.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling 855-267-3837, or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. It is not possible to invest directly in an index.

Amplify ETFs are distributed by Foreside Fund Services, LLC.